When you are dead and a famous writer, your journals will give your readers insight into your life, thoughts, and process. The best way to remember how to do journal entries and how each account is affected is through practice. This idea can be extended to all accounting fundamentals, as there are many accounting rules that need to be upheld. This is posted to the Cash T-account on the credit side beneath the January 18 transaction. This is placed on the debit side of the Salaries Expense T-account.

The steps are the same as in the double-entry bookkeeping. XYZ company decides to buy new computer outstanding expense software for $1,000. They pay $500 in cash right away and agree to pay the remaining $500 later.

Chapter 1: Introduction to Accounting

The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side. An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event. 1In larger organizations, similar transactions are often grouped, summed, and recorded together for efficiency. For example, all cash sales at one store might be totaled automatically and recorded at one time at the end of each day.

What is a Journal Entry? A Beginner’s Guide – The Motley Fool

What is a Journal Entry? A Beginner’s Guide.

Posted: Wed, 18 May 2022 16:53:26 GMT [source]

A journal entry is no more than an indication of the accounts and balances that were changed by a transaction. It is a good idea to choose your target journal before you start to write your paper. Then you can tailor your writing to the journal’s requirements and readership, to increase your chances of acceptance. On this transaction, Accounts Receivable has a debit of $1,200. The record is placed on the debit side of the Accounts Receivable T-account underneath the January 10 record.

General structure for writing an academic journal article

The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000. Manual journal entries were used before modern, computerized accounting systems were invented. The entries above would be manually written in a journal throughout the year as business transactions occurred.

- These entries would then be totaled at the end of the period and transferred to the ledger.

- This video is an extra resource to use with this guide to help you know what to think about before you write your journal article.

- Write for fifteen minutes about some aspect of your day as though you were writing in a journal.

Accrual accounting is really made up of two distinct components. The revenue realization principle provides authoritative direction as to the proper timing for the recognition of revenue. The matching principle establishes guidelines for the reporting of expenses. These two principles have been utilized for decades in the application of U.S.

Analyze Transactions

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company.

Office for Standards in Education, Children’s Services and Skills … – GOV.UK

Office for Standards in Education, Children’s Services and Skills ….

Posted: Wed, 09 Aug 2023 07:00:00 GMT [source]

The expense resulting from the asset outflow has been identified previously as “cost of goods sold.” Like any expense, it is entered into the accounting system through a debit. This will go on the debit side of the Supplies T-account. You notice there are already figures in Accounts Payable, and the new record is placed directly underneath the January 5 record. In the journal entry, Accounts Receivable has a debit of $5,500. This is posted to the Accounts Receivable T-account on the debit side.

Automate Journal Entry Creation Using Accounting Software

The studies you cite should be strongly related to your research question. An introduction is a pivotal part of the article writing process. An introduction not only introduces your topic and your stance on the topic, but it also (situates/contextualizes) your argument in the broader academic field.

- The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side.

- These two principles have been utilized for decades in the application of U.S.

- We briefly mentioned the general journal in the beginning.

- Use “et al.” for 3+ authors in MLA in-text citations and Works Cited entries.

Let’s look at some simple ways to start capturing ideas. Accrual accounting provides an excellent example of how U.S. GAAP guides the reporting process in order to produce fairly presented financial statements that can be understood by all decision makers around the world.

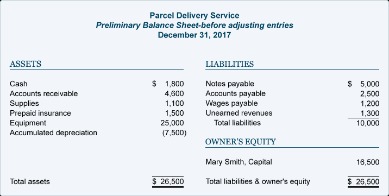

You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side. Note that the total of all the debit and credit balances do agree ($54,300) and that every account shows a positive balance. In other words, the figure being reported is either a debit or credit based on what makes that particular type of account increase. A journal is the company’s official accounting record of all transactions that are documented in chronological order.

Double-entry bookkeeping isn’t as complicated as it might sound. To understand the concept, think about any purchase you’ve ever made. A) Credit purchase of goods or material other than the goods dealt in by the business. In Chicago notes and bibliography style, you include a bibliography entry for each source, and cite them in the text using footnotes.

About This Article

Your journal entry might be a drawing, a poem, a list of words, or a list of cities you drove through. You may never sell more than one hundred copies of your book, you may never publish your writing, or your journals may only be read by the mice that crawl through your basement. Or your journals will be read by zombies after the zombie apocalypse, sharing insight into your life and daily routines. Writers are collectors of ideas, and where do we keep them? On scraps of paper, napkins, the notes app of our phones, and sometimes in journals. But as anyone who’s started a journal can attest, sometimes it’s hard to begin and even harder to keep one going.