Intuit is proud to be an equal opportunity and affirmative action employer. We also consider qualified applicants regardless of criminal histories, consistent with legal requirements. If you need assistance and/or a reasonable accommodation due to a disability during the application or recruiting process, please talk with your recruiter or send a request to Enhance your own finances while helping small businesses manage theirs.

Of course, candidates should be tech-savvy in this day and age. Finally, you must be able to do these things from the comfort of your home, which means you shouldn’t be a procrastinator or easily distracted. Maintains a thorough knowledge of client billing and payment terms, discount arrangements, lawyer and client preferences.

Two years ago, prior to the pandemic, we gathered at the Cosmopolitan Hotel in Las Vegas, and we’ll be gathering there again on May 31, 2022. Even before the pandemic, commuting was linked to stress and job burnout. Working from home gives you more opportunities to take walks, eat healthier foods, and improve your work/life balance. Options for creating budgets to better structure and assess business performance. Bank Reconciliations on a monthly basis, as well as any postings needed for AR.

Senior Cloud Accountant

Kruze is passionate about serving our clients through the creation of clear financial performance analysis delivered through excellent project management. Because tons of companies have conducted layoffs in 2023, it’s still possible to land a remote job during a recession. By registering you agree to the Virtual Vocations Inc. All users receive free access to a select number of job postings. Paid membership is required for full access to our remote jobs database. This role will be a primary contributor to the month-end and year-end general ledger close process and will assist in other projects as needed.

Still, a degree in a math-based subject tends to catch the eye. We offer complete coordination and integration with your existing team. We hold excellent skills and expertise in using AppFolio and Buildium software to perform bookkeeping effectively. With our risk-proof & no-fail setup, you need NO resources to hire employees and deal with their training and payroll. SimplyHired may be compensated by these employers, helping keep SimplyHired free for job seekers.

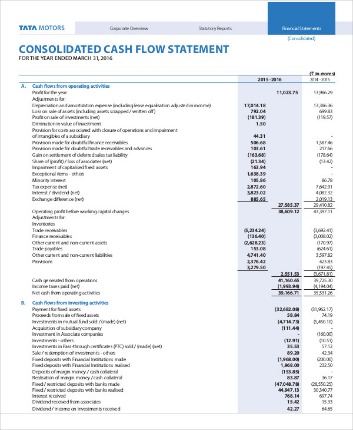

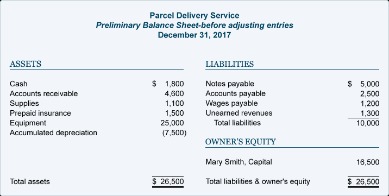

Journal entries, such as accrued liabilities, transfer price adjustments, finished goods, inventory reserves, standard cost revaluation, contract manufacturing. Balance sheet account reconciliations and account roll forwards, including variance analysis. Process and reconcile a high volume of customer payments. Includes monitoring and responding to requests via Credit Phone line and Email Inboxes. Bachelor’s degree and 3-5 yrs in Accounts Receivable/Credit Management.

Supporting Strategies

Please review our available positions and we encourage you to apply. Kruze Consulting was named one of the top accounting firms to work for in 2022 by Accounting Today. Providing clients real time answers with details to back our findings. First, make sure you meet all of the qualifications and that your QuickBooks Online Certification is up to date. Once you apply online, a recruiter will contact you and complete a phone screen. If you continue the process, someone will contact you to set up additional interviews with our team.

Become a QuickBooks Live bookkeeper and help small businesses manage their books. Because tons of companies have conducted layoffs in … This is a part time position and with flexible hours and the ability to work virtually, occasionally onsite support may be required.

Bookkeeping Jobs – Remote Work From Home & Flexible

The majority of job specifications demand a bachelor’s degree regarding education, with a master’s or doctorate more likely to land you a job. In this section, we’ll outline the key takeaways from sixteen roles popular among candidates applying for remote jobs in accounting in the US. This turnaround time helps you maintain low time-to-market figures, helping you attract customers before your competition. With an outsourced real estate bookkeeper, however, you needn’t worry about losing much of your budget.

5 Freelance Jobs That Are on the Rise — and 5 That Are Becoming Less Popular – GOBankingRates

5 Freelance Jobs That Are on the Rise — and 5 That Are Becoming Less Popular.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

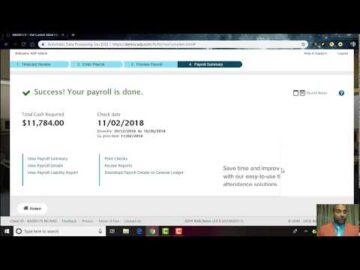

Credit control – you will reconcile incoming payments for all quickbooks payroll… Execute the setup, configuration, and testing of accounting rules. Ensure setup is consistent and in line with GAAP and company requirements. Execute the setup and configuration of Legal Entity Rules, and develop an approach to system issues or new…

Revenue Accounting Manager

The National Association of Certified Public Bookkeepers is another fantastic certification for anybody interested in remote bookkeeper jobs. Evaluating the assets is important as the company’s financial statements need to be reliable. Until the point that exchange happens, the genuine value is obscure. Therefore accurate asset evaluation and generating financial statements and income statements are essential for accounting purposes. Manage your assets, evaluate their values, and plan your moves with data-driven insights with our property management accounting solutions. Entering all these transactions manually can consume a lot of time, and the cumbersome nature of the task means it’s ripe for typos and other mistakes.

Like all remote accounting jobs that deal with the SEC, a CPA is a legal requirement. Extra certifications that help tax specialists include everything from IRS updates to magazine subscriptions. However, the most popular certification is that of the National Association of Tax Professionals. A voluntary organization, it assists its members in all things tax preparation so that you don’t lose your competitive edge.

Avoiding Taxation Pitfalls

In one of the remote accounting instructor jobs, you’ll teach key concepts in easy-to-understand terms by creating specific lesson plans. If so, you’ll likely need job-cost accounting and a wide variety of internal management reports that are not available in QuickBooks Online. “QBO”, according to Intuit tech support, is NOT designed to track or deliver the detailed job costing reports that most construction, manufacturing, and service companies need. Keeping track of your revenue is equally important to restaurant accounting as knowing your expenses.

- A stable plan is needed, and our remote bookkeeping advice can provide one.

- Others, however, might ask for a CPA if they themselves are a Certified Public Accounting firm.

- BA/BS degree and 2+ years of progressive experience in accounting, specifically GAAP-compliant accounting…

- Suitability for a range of property portfolios in the commercial space, including rental-residential.

- Manage your assets, evaluate their values, and plan your moves with data-driven insights with our property management accounting solutions.

- Also performs key duties in maintaining functionality of the General Ledger software system; and provides financial information to internal/externa…

Opportunities for remote accounting jobs can be found here. Some of the common opportunities include CPA, bookkeeping, tax professional and more. Opportunities may also include accounting software support. Companies you might find hiring for remote accounting positions include Zapier, Automattic, Swyft and Twilio. For remote accounting jobs, the name is as self-explanatory as it gets.

Furthermore, contrary to common assumptions, it does not have to be a significant headache or inconvenience. The money you bring into your bookkeeping services for the real estate business is highly significant. Items like gas and tolls, work clothes, parking fees, and other expenses drop when you work from home. In addition, parents may be able to cut back on child care expenses when you’re able to adjust your schedule around school and other activities. And let’s not kid ourselves – employers can save money too on office space and other facility expenses.

Strong project management skills are also required, so employers generally want a minimum of eight years of background experience. Remote bookkeper jobs are similar to that of an accountant, but the responsibilities are mainly focused on numbers. This is one of the work from home accounting jobs that are perfect for career-driven accountants who want more flexibility. Being able to manage accounts is a fantastic skill, but it’s important to have extra independence as you get older. A remote account manager position allows you to maintain a high level of authority without being tied down by a manager and office combination.

10 in-demand side hustles and jobs you can do from home—one can make almost $100,000 a year – CNBC

10 in-demand side hustles and jobs you can do from home—one can make almost $100,000 a year.

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

They have their own proprietary software that helps them manage their remote staff and work-flows, but they use QuickBooks Online to serve their clients. Customers will schedule a time to engage services, and the Bookkeeper will work on their books with them. Cloud Accounting Specialists provide a variety of bookkeeping services to small businesses throughout the country. Be part of our diverse team, and contribute to Company’s continued growth….Requirements Degree, certificate, or adequate experience in bookkeeping/accounting. CAS requires both an Advanced Accounting skill set, and a Customer Service skill set. Our client, an established Boston-based construction and RE development firm, is searching for a Controller to lead the accounting and finance functions for the firm.

- Prepare month-end financial statements and reports.

- A CPA isn’t necessarily obligatory for remote accounting jobs USA, yet acquiring Certified Public Account status proves you are able to work in the state.

- Opportunities for remote accounting jobs can be found here.

- The National Association of Certified Public Bookkeepers is another fantastic certification for anybody interested in remote bookkeeper jobs.

- Become a QuickBooks Live bookkeeper and help small businesses manage their books.

Grad students tend to fall into tutoring, as the job offers good money and the ability to schedule work around life. For obvious reasons, your education will need to center around accounting. In the US, the American Society for Quality is a professional certification that improves your ability to earn more and secure promotions as an assurance specialist. ASQ certification isn’t a mandatory qualification, yet it helps recognize experts within the quality assurance sector. There are very few college programs that focus on the subject, and fewer regulators. Don’t assume tax specialists only help soulless corporations, either.

The role reports to the firm’s COO/CFO, but will take on as much of the finance… Be responsible for supporting the finance team in maintaining accurate financial records and preparing financial reports. They will also ensure compliance with accounting regulations and internal controls. Download, compile, categorize, and manipulate the… Performing assigned monthly, quarterly, and annual general ledger closing processes.